Note: I have written the below for myself in order to make sense of the euro-crisis that I have been following over the last year. It is basically a long summary of the different perspectives and theories that for me made the most sense. Writing them out allowed me to process it and put out my own thoughts in a somewhat coherent way. If other people get something out of it by reading; great. I would of course be glad to hear criticism/feedback or whatever.

The Eurocrisis

It is maddening. The amount of bullshit that you hear. The constantly repeated myths of lazy Greeks and profligate South-European governments. The unquestioned acceptance for the need of austerity. The Dutch media implying that staying within the EU mandated 3% government deficit is in the national interest. Suggesting that failing to do so will put “our children” and future generations at risk. Dismissing anyone who disagrees with that as a populist similar to Geert Wilders. And the fiscal pact that is about to be ratified is left undiscussed. And now also with Christine Lagarde offensively suggesting the problem is that common Greeks are not paying their taxes and that they should not whine as the little kids in Niger suffer so much more. Oh yes, of course, the IMF has done so much to help the little kids in Niger. Rather than blaming Greeks or profligate governments and being all moralistic about paying taxes and spending, it is important to make sense of the structural problems that are inherent in the eurocrisis.

And most of it is really not that difficult. Lets start with Greece. Greece is in the worst position obviously, but I can promise you that if it weren’t for Greece, the financial markets would be ganging up on another European country. Merkel and co now seems to believe that they may be able to get Greece safely out of the eurozone without the whole thing collapsing and to then just wait it out (for the economy to magically kickstart I guess). But that’s not going to work out. And the economies are too interconnected to allow for bigger countries than Greece to fall.

Another important thing to point out is that all the so-called “PIIGS” (Portugal-Ireland-Italy-Greece-Spain), as is the commonly used degenerate term, are all different from each other and all have different reasons for why their economies are currently in such a mess. There is a dominant media narrative out there that blames the crisis on profligate Mediterranean governments, but this narrative is blatantly false. Spain for example ran budget surpluses until 2008, unlike ‘profligate’ Germany that did not even manage to stay under -3% for 4 years in a row during the ‘boom’ as mandated by Growth and Stability Pact (which they bargained for themselves – of course Germany did not have to pay the corresponding fines) .

And then came the economic crisis. After the collapse of Lehman Brothers the powers that be did not want that to happen again and started bailing out the banks that started falling like dominoes. European governments were pressured (also by the EC and other external powers) to bail out their over-leveraged banks (that took too high risks, allowed for by regulation pressured by the EC). Suddenly European countries spend trillions saving their banks. A government debt crisis ensued. Borrowing rates are much higher than the growth forecasts, leading to a debt trap. Financial markets started speculating against the apparently weaker peripheral European countries, so they could no longer borrow money from the private markets at reasonable rates, and borrowing from the core European countries at (barely..) better rates included conditions for neoliberal austerity – worsening the peripheral countries’ growth perspectives even more.

The structural problems inherent in the European Monetary Union (which plenty of people saw and warned for in ’99 but were ignored) became apparent. Only the ECB can print money. The ECB follows neoliberal monetary policy under which it is independent of government (and “populist appeals”) and is just there to maintain a low inflation rate. Member states gave up their monetary sovereignty to the ECB and the Stability and Growth pact was there to bring convergence on the inflation, interest, growth rates. But what we are stuck with is a Eurozone with one common monetary policy, while other socio-economic policy is on a national basis. A monetary union without fiscal union. JPMorgan recently looked whether the right conditions to set up a monetary union in Europe and they found an astonishing amount of differences between the Eurozone´s member states in key variables. They compared it other hypothetical currency unions and it turns out that the “euro zone is the most implausible currency union of them all. It would be slightly more realistic, in fact, to bind together all the countries in the world that began with the letter “M””. The monetary union still worked while the economy was growing (even though it was partly credit-driven, especially in the “PIIGS”), but the uneven development within the Eurozone was brutally exposed when the economy came crashing down in 2008.

The Eurozone has been very good for capital that can freely move across borders looking for a profit to make, especially the big multinationals (often from the core countries) have benefited immensely. The European member-states however end up competing with each other in order to attract this capital. A race-to-the-bottom in order to improve competitiveness ensues.

Conventional wisdom proclaims there are two ways for a country to become more competitive. One is external devaluation, when individual countries run their own currency, they can print money, devaluate and thereby become more competitive. This is ruled out in the Eurozone, as only the ECB can print money [this is also why the UK outside the eurozone can run its current budget deficits without consequence]. The other way to become more competitive then is internal devaluation, which is is to reduce labour costs. Germany in the last 20 years has been quite busily doing just that, with even the German social-democrats (forgetting their old ideals and becoming neoliberals) increasing precarious employment with so-called “mini-jobs”, striking an union-employers agreement that agreed on lower wages in return of low unemployment, and by keeping wage increases under inflation.

According to neoliberal dogma the rest of Europe then has to compete against all that by lowering their own labour costs. That’s where this Holy Austerity Crusade comes from with the troika (ECB-EC-IMF) and Merkozy demanding wage-freezes, lower minimum wages, removal of pensions, cuts in public spending. Leading to unprecedented levels of social collapse and misery, with their economy going down by a fifth since 2007, with pensioners going through the garbage looking for food, suicides going up 22% a year, young people becoming drug addicts, with people being underemployed and not even having the money to pay the electricity bills. Looking at the mass levels of unemployment and increasingly lower economic forecasts, internal devaluation by lowering labour costs is simply not working. Low labour productivity has not been the cause of the problems of the “PIIGS” and lowering labour costs won’t the solution. The idea of Germany outsourcing jobs to Greece is nonsensical when East European countries with much lower costs of living are taken into account.

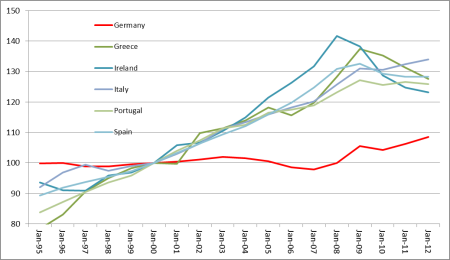

Unit labour costs index = 100, start = 1995

“Convergence gave way to divergence in the ability of each Eurozone state to compete. That can be measured by the costs of capitalist production: Germany just outperformed the likes of Greece, even though Greek workers put in the longest hours and were paid the lowest (see my post, Europe: default or devaluation,16 November 2011). Look at unit labour costs. Germany’s hardly moved as wages were held down and productivity was high. Greece’s rose 35% compared to Germany’s even though Greek productivity increased and labour toiled.” (From Micheal Roberts – Euro Calamity 12-12-2011)

But the powers that be are so stuck in their neoliberal dogma they just keep repeating the same lines. Unelected technocrats like Mr Mario Draghi of the ECB declare the social welfare state to be death. The people rightfully disagree with 11 governments collapsing due to the crisis so far.

The new constitutionalism of Europe

The pressure on European welfare states to balance budgets by cutting social spending comes external forces outside popular accountability; financial markets, foreign states, and in this crisis most importantly; the troika of EC, ECB and the IMF. In effect, European member-states have to put on the so-called “golden straitjacket” as coined by NYT columnist Thomas Friedman, shrink the state and privatize or suffer. But unlike what the hilarious writings and analogies of Friedman and others might want you to believe, this straitjacket is not something inevitable or natural phenomenon, but rather something that comes from political choices made by human beings.

It is important to note that what the periphery of Europe is going through currently is not exactly new. Their experience closely echo what Latin America and much of the third world went through since the 80s, which also had the IMF (together with the World Bank) put neoliberal austerity conditions (structural adjustment programs) on its loans, forcing poor countries to demolish their public sector and to privatize basic public services. The world’s core-economies used its creditor status to the periphery through the IMF and World Bank to force these developing economies open for capital accumulation, to turn them dependent on exporting (raw) commodities (by foreign private companies), and to open up their labour markets to exploitation by companies from the core-economies.

A concept that helps us to make sense of how sovereign states are restrained in what economic policy they can pursue is that what Stephen Gill calls the ‘new constitutionalism’. Constitutions function as a control mechanism that set out the rules of governance and that restrain those in power on what they can do. The new constitutionalism then is a process that aims to shield the new global political-economic structures from democratic rule and popular accountability in order to grant privileged rights to corporate capital and large investors. It is all about market efficiency, discipline and confidence. Policy credibility and consistency viewed in the light of neo-classical economic theory. Measures are taken to reconfigure the state apparatus into facilitators of market values and market discipline. This new constitutionalism has been deliberately pursued by international institutions as the IMF, World Bank and WTO, and the world’s most powerful states. The separation of the ‘economic’ and the ‘political’ is redefined, market policies are ‘locked-in’ externally (under the WTO for example; nations are in many ways prevented from defending their national industries), and elected governments are no longer able to do decide over the most fundamental.

The new constitutionalism can be seen as most central in the European Union. The European Monetary Union has been a long term project to abolish popular influence on macro-economic policy. A substantial amount of all regulation (some say over half) now comes from the EU, over which mostly unelected eurocrats in Brussels have decided, often in cooperation with unelected lobbyists from the corporate world. The fiscal pact that was signed by 25 of 27 member states at the previous EU summit will entail another serious escalation in the new constitutionalism of Europe. They call the pact a “fiscal stability union”, but “rather than creating an inter-regional insurance mechanism involving counter-cyclical transfers, the version on offer would constitutionalize pro-cyclical adjustment in recession-hit countries, with no countervailing measures to boost demand elsewhere in the eurozone. Describing this as a ‘fiscal union’, as some have done, constitutes a near-Orwellian abuse of language“. As with the Sixpack it will essentially imply sacrificing democratic participation on macro-economic policy in favor of imposing austerity on the member-states. The fiscal pact will enforce fiscal budget balancing by adopting debt brake and an automatic austerity mechanism. These measures are signed up as a treaty under international law so it can sidestep European law, which would have assured at least some democratic and judicial control within the EU. Furthermore, national governments are pressured into ratifying the treaty as it used as a pre-condition for receiving aid from the European Stability Mechanism (the new bail-out fund for when the crisis hits again). Considering that currently 24 out of 27 EU countries are currently running a deficit, this will in essence mean constitutionalizing “austerity forever” and put the right to collective bargaining under further assault.

The crisis of capitalism

It is important to link the eurocrisis with the wider crisis of capitalism in the Western world. Although the total government debt compared with GDP for Eurozone countries is much lower than that of the US, solving the structural problems within the Eurozone would refocus the attention of the financial markets and media towards the US. But even then, with the eurocrisis resolved, Europe would still be part of a world that is unlikely to return to the growth periods we saw in the 20th century, especially in the Bretton Woods period after WW2.

After the oil crisis of the 1970s and the end of Bretton Woods the world economy saw an increasing amount of recurrent crises that started following up on each other on increasingly shorter intervals. The boom and bust cycle of the core-economies has been getting shorter and shorter. The Great Recession that we have been in since the housing bubble in the US burst in 2007 has seen lowest recovery since the Great Depression; a jobless recovery even though fortune 500 corporations and Wall Street were promptly highly profitable again. Many European countries, including the core-economies, are slipping back to recession. It is time to question why this is the case, to find out where the Great Recession came from, and why a normal recovery is not coming around. In other words, it is time to question the structural underpinnings and assumptions of our capitalist system. These are questions that are ignored by the mainstream media and economics, as Nouriel Roubini argued: “Crisis economics is the study of how and why markets fail. Much of mainstream economics, by contrast, is obsessed with showing how and why markets work – and work well.”

So what is the official line of where the great recession came from? They did not see it coming, claiming it was a black swan, a perfect storm that can only come together once or twice a hundred years. Alan Greenspan found out that his ideology was not right, that it was not working . The dominant neoclassical school was obsessed with its beautiful mathematical models, turning a blind eye to human irrationality and market imperfections. The finger is then pointed at deregulation, banking gone wild with deriviatives and packaged securities of which trillions are traded but which almost nobody is really able to value. This financialization that had less and less to do with the real underlying economy however also happened for a reason.

There is the underconsumptionist thesis which links increased inequality with an increased risk of major economic crisis. The argument here is that lower consumer demand can lead to a recession, especially when this is not counteracted by for example public spending as proposed by the Keynesians. In the last 30 years wages have stagnated relative to productivity (they used to go up together in the golden decades of capitalism post WW2), as the rich have been fighting class war and have been winning in the words of Warren Buffet. And the decrease in wages leads to lower consumptions; this was countered by extending credit to households (creditcards for all!), but that cannot go on forever, it´s a debt bubble that has to burst and this first happened in the subprime mortgages.

Following this logic through shows that less money going to labour and the increased inequality (which greatly increased almost everywhere the last 30 years) that comes with it greatly destabilizes the system. The rich at the top and corporations have an increasing amount of money to invest with a decreasing amount of profitable places to invest in due to underconsumption (overproduction being a different side to the same coin). A dominant myth is that it’s good for corporations and rich people to have loads of money as they are the ‘job creators’; give them tax-breaks and they will invest in innovative businesses that will create jobs. In reality, instead of reinvesting profits in expanding their activities, corporations prefer to pay excessive bonuses to their executives, pay out dividends to shareholders, or engage in financial speculation. While governments are forced into austerity and unemployment remains high, US corporations are hoarding more than a trillion dollar in savings (it’s the same in Europe – Dutch businesses have over 210 billion in corporate savings). Instead of investing it in the real economy and ‘creating’ jobs, capital is pumped it into speculative bubbles all over the world (leading to increasingly short boom and bust cycles). An abundance of cheap labour abroad, the ensuing offshoring, and new technology and automation of production further depresses the share labour in the core-economies receives from corporate profits.

An alternative theory that corresponds with most of the reasoning outlined above comes from Marxists that look at the declining profitability of capitalist production. This theory is however fundamentally different on an important aspect. It doesn’t see neoliberalism as a political-ideological movement, as class-warfare waged by the rich, but as the result of limited political choices that comes from the problems inherent in the capitalist production process that became increasingly problematic in the years of stagflation in the 70s after the golden years of capitalism. The tendency of the rate of profit to fall argues that improvements in technology and higher productivity, while increasing the amount of material wealth, lower the profit that can be extracted out of (productive) labour, leading to crises and “poverty in the midst of plenty”. This lack of profitability rather than lack of ‘effective demand’ (/underconsumption) then explains the financialization that we have seen since the 70s, in which stockbrokers attempt to turn money into more money by inventing increasingly complicated ´ficticious capital´ (derivatives etc). But when this over-investment in credit markets is not backed up by real profitable investments in the global economy the bubble bursts, hence the great recession. The theory is logical and sounds convincing. Empirically proving it is however a different matter. There are many disagreements on how to calculate the rate of profit. I am not an expert and find it hard to judge the arcane and heated debates that Marxist economists have on this issue, but I can recommend the writings of Andrew Kliman, Micheal Roberts and Choonara’s write-up.

What both the underconsumptionist and falling profitability thesis have in common is that we should stop accepting the attack on so-called ‘entitlements’ and that it is time for a fundamental rethink. Think about it. In many ways we have never had it this good. In much of Western-Europe we have constructed welfare-states, where people that are unfortunate enough to become sick are taken care of and treated in modern hospitals without ending up indebted for the rest of their lives, where people unfortunate enough not to find a job receive help from the government and do not become a burden on their families and community, where people after a life of work can enjoy their well-deserved pension. We have beautiful modern technology. Smartphones with access to internet everywhere. Small machines which fit in your pocket, that can stream all the music and movies of the world. More people than ever enjoy modern housing that is keeping us dry and warm. Relatively speaking we have never had this few people producing food for billions of people. Much hard manual labour has been replaced by machines and robots. Assembly lines require less people than ever before. Productivity has skyrocketed. Why then is it still expected that people work 40 hours a week? Why then are our hard-fought social securities going down. Why then is the newest generation the first generation since WW2 that is beyond doubt worse off than the previous generation? Why are these questions not asked and do we simply accept the austerity and increasing social misery as a given that we will just have to live with?

Margaret Thatcher’s mantra of there-is-no-alternative (TINA) is often repeated. Fact is however: there has to be. For the sake of humanity there has to be. In this day and age it is still hard to imagine a live outside our capitalist reality. The people thinking out alternatives often seem utopian, but the real utopians are those who think the current neoliberal order will be the best for humanity. Because where does this endless drive of deregulation and privatization lead us? What exactly is this end game they envision, these so-called liberal-democratic states in a free-market capitalist world in the supposed end of history? Is this truly the final goal we as humanity can achieve, is there nothing better? To be endlessly dragging ourselves down to become more competitive? You really think that this will lead to a point where there’s a world’s labour force of 5+ billion people employed in 9 to 5 jobs and where everyone is able to live on a decent standard of living? That to me seems like the real utopianism.

Neoliberalism as a world agenda or even as a European one is also easily discredited. These reforms in order to become more competitive by lowering labour costs also lower the world’s total capitalist investment, as the market becomes smaller due to lower demand (because workers can buy less). Individual regions and countries´ manufactures may increase production by following a neoliberal agenda due to a reduction in labour costs, but it comes at the expense of the rest of the world. Stagnating wages (relative to productivity and even inflation) and flexibilization of the labour market with “mini-jobs” may have been quite successful for Germany, but it comes at the expense of the rest of Europe. It’s a race-to-the-bottom basically and it’s the utopian aspect of neoliberalism that they never think through the bigger picture of their reforms. The new constitutionalism with the reforms of the Washington Consensus through the IMF, WB and WTO were good for Western corporations and capital, which in theory trickles down to the common people in the Western world, but as a result of the reforms all over the world, the West-European model of social-democracy is under threat as well. In the wider perspective we’re all going down because of the neoliberal reforms. These are basically capitalist grounds on which the neoliberal agenda has to be opposed. If they want to save European capitalism, the folks in Brussels better start to listen.